November 10, 2021

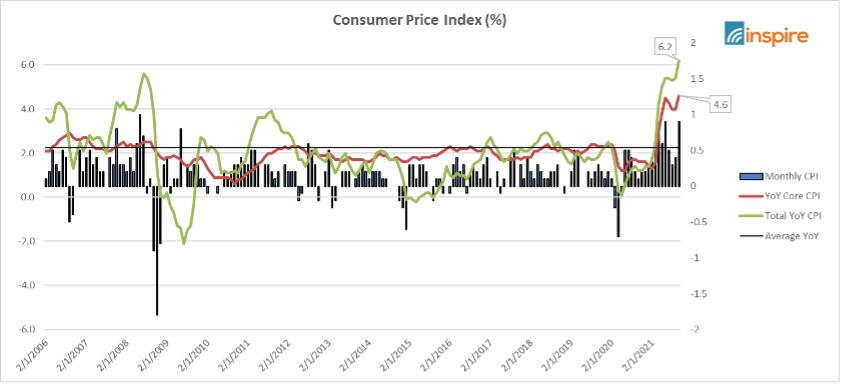

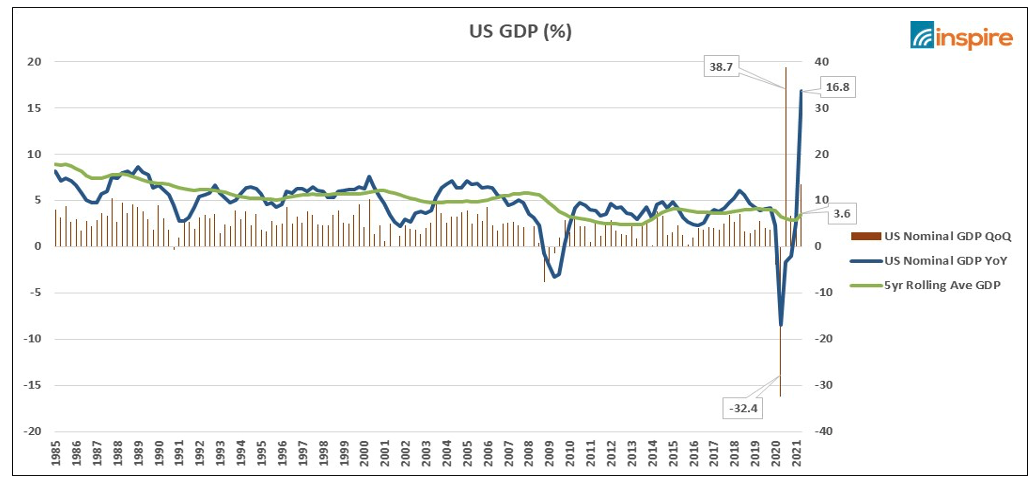

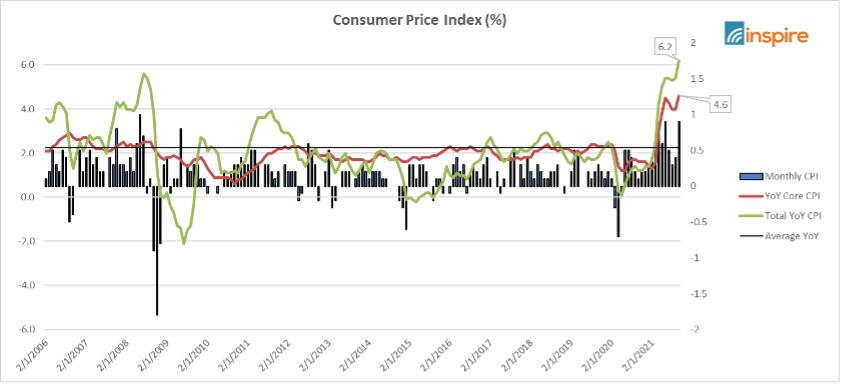

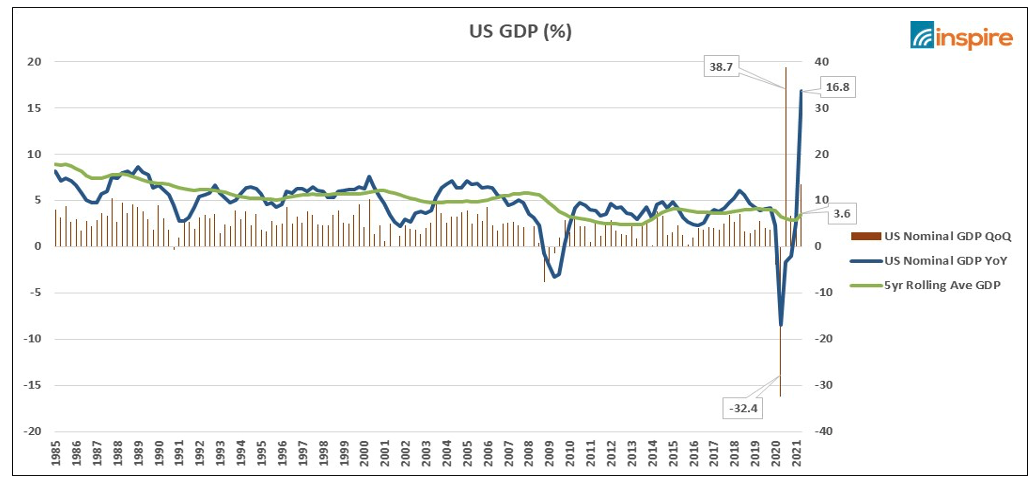

October’s higher than expected reading on inflation caught many investors' attention and is sure to be the source of more market volatility going forward.

Of course, a key question is whether inflation will remain elevated or fall back down to pre-pandemic levels. While there are many unknowns and it's still too early to answer the question definitively, here's where Inspire's investment team is focusing its attention.

The Headline Numbers

Beneath the Headline Numbers

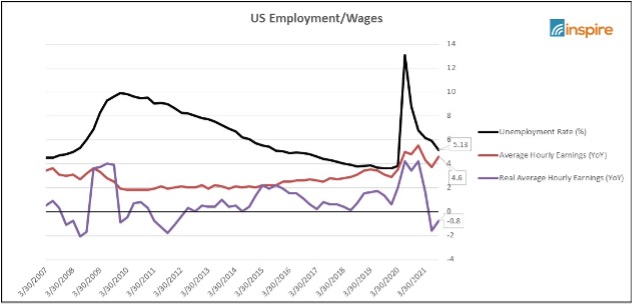

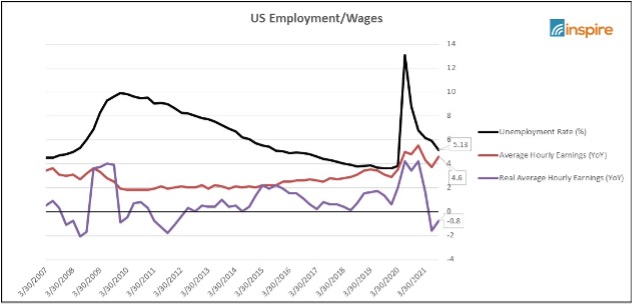

Employment

US Money Supply & the Velocity

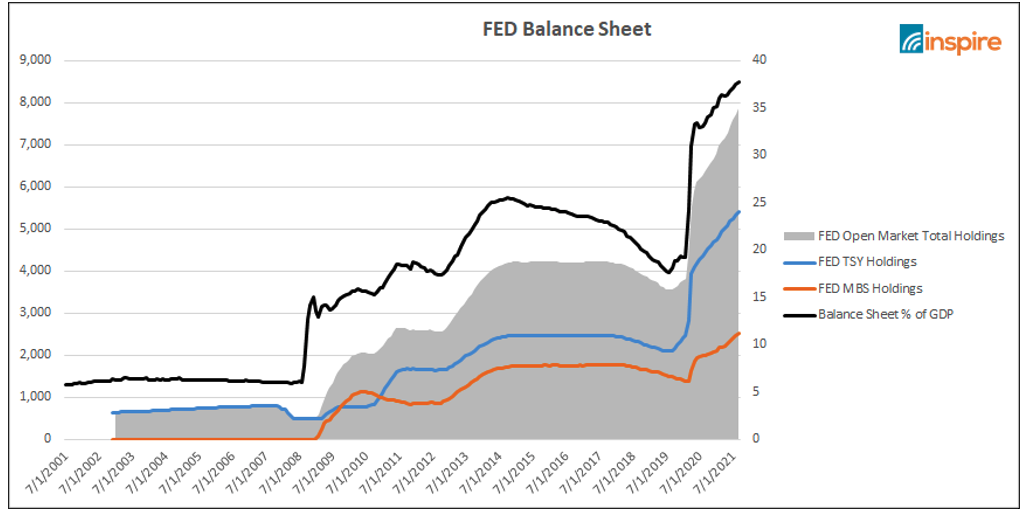

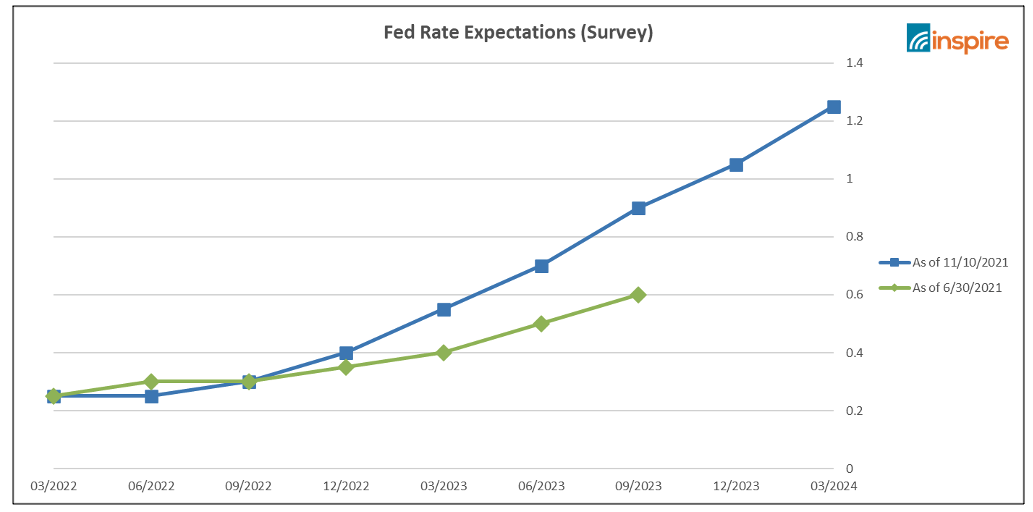

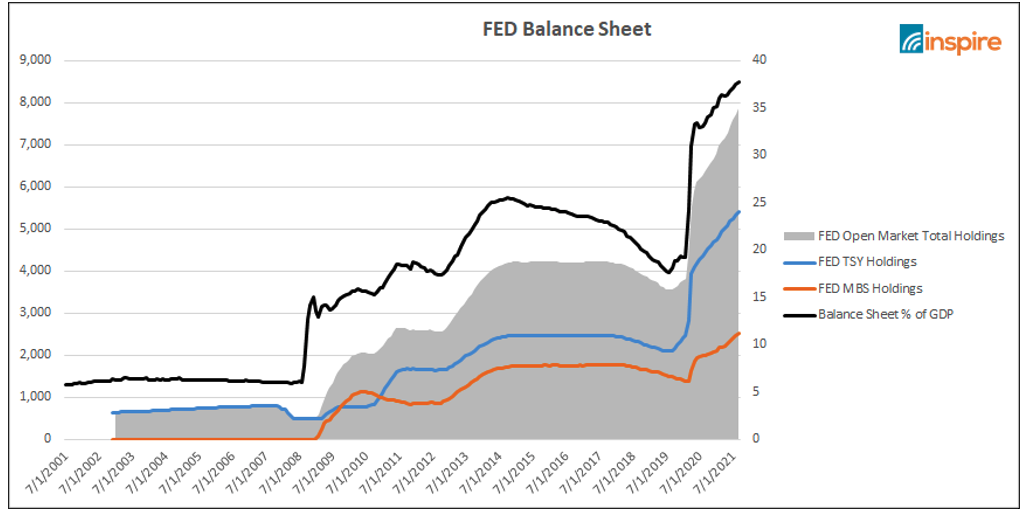

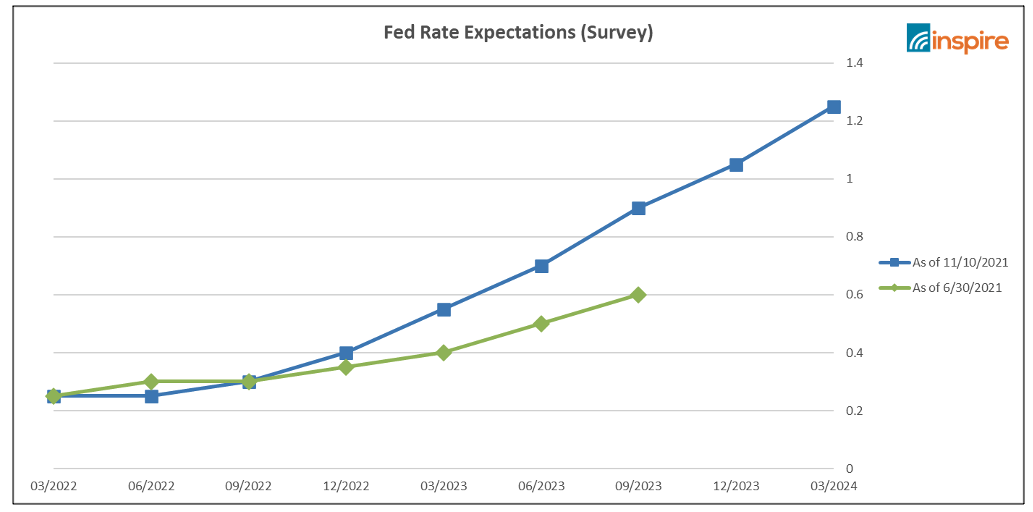

The Federal Reserve (FED)

The looming question we all have is the FED's response to this latest inflation data.

The FED has two active tools in place that have been in full 'stimulus' mode up to this point. However, we are starting to see indications that they may begin to take their foot off the accelerator over the coming quarters, though still a long way from 'putting on the brakes.'

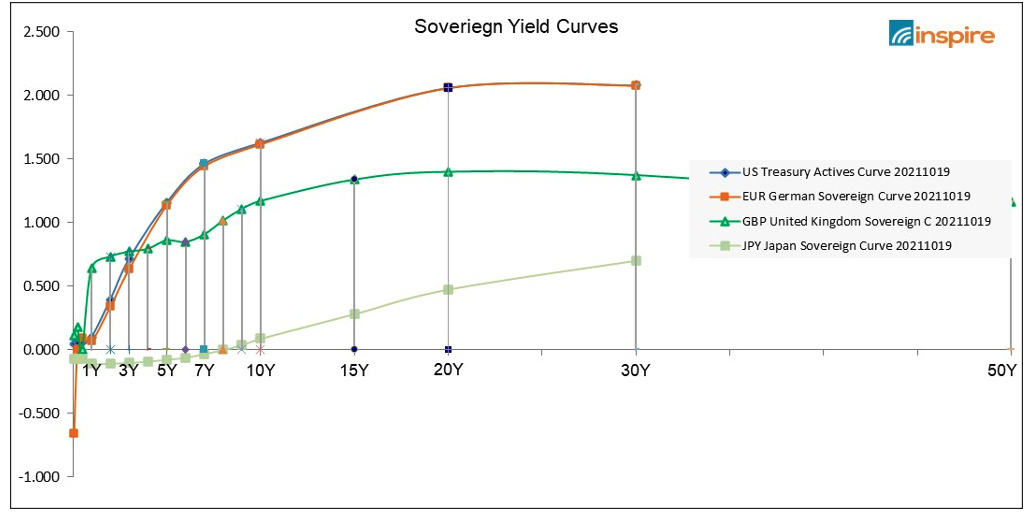

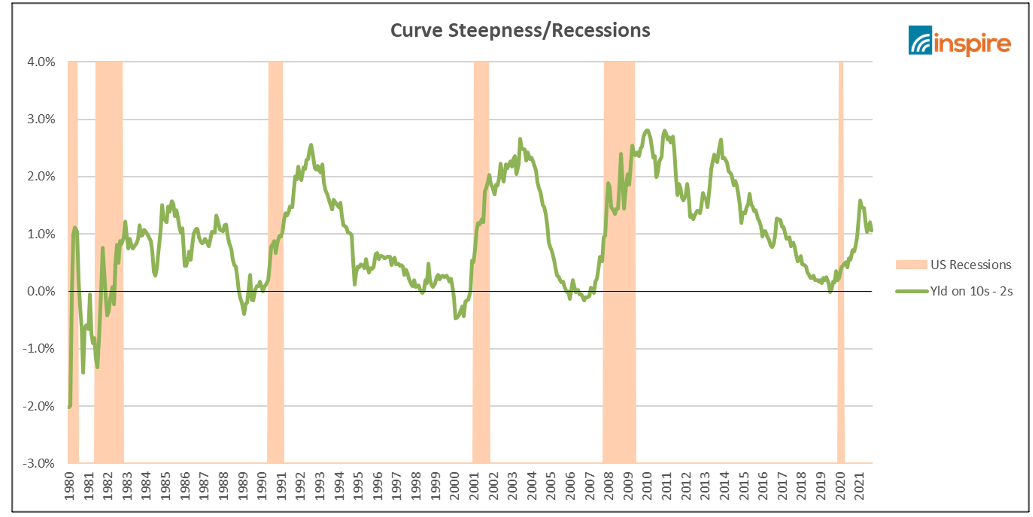

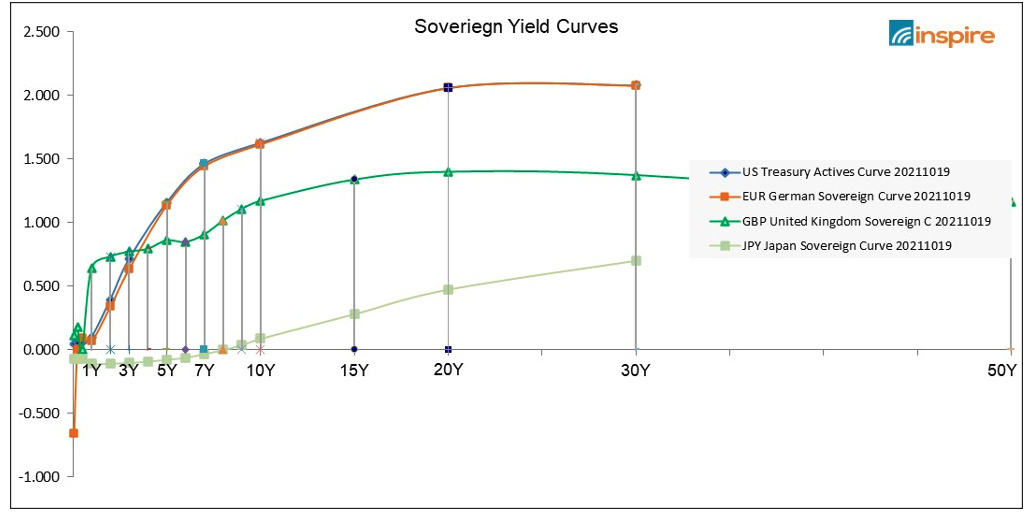

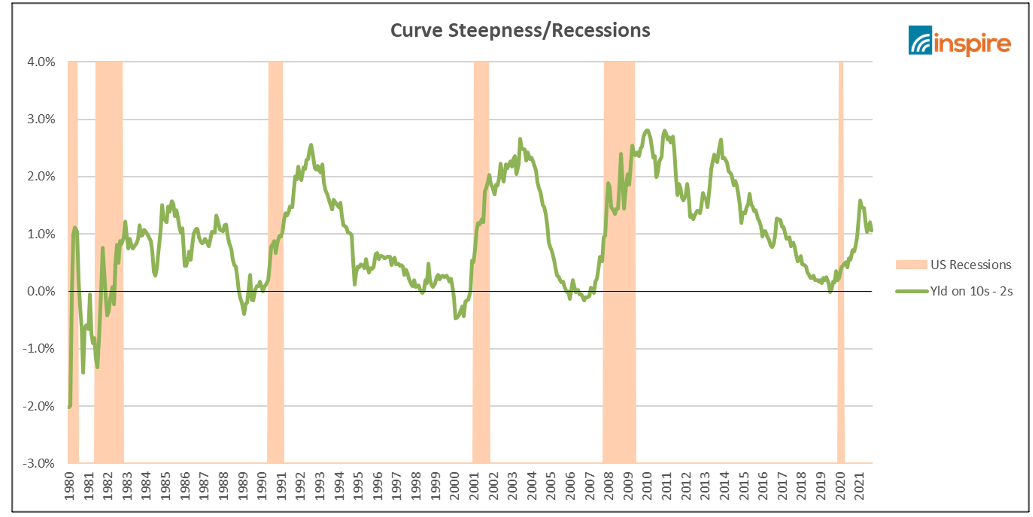

Global Interest Rates

The level and shape of the yield curve can show the baseline cost of capital for various time horizons. It can also give insight into the market expectations for economic growth and inflation in the future. An upward sloping curve is constructive as it indicates a normal functioning economy.

As the curve begins to flatten or (more ominous) invert, this suggests that economic growth may be in question over this time horizon.

Both measures have different implications depending on the specific sector. For example, financials borrow short-term money through deposits and make longer-dated loans to borrowers, thus benefiting from a higher spread between those rates (steeper curve). Other sectors, such as utilities, are more concerned with the actual level of rates since they tend to have higher debt levels and cannot quickly pass those costs on to customers as rates rise. Similarly, real estate generally carries higher debt loads and thereby has increasing capital costs in a rising rate environment. However, they are more quickly able to pass these rising costs on to customers in response (raise rents). Also, from an inflation perspective, real estate companies are holding 'hard' assets that appreciate along with that inflation and thereby are not directly impacted in the same manner as other businesses.

Fiscal Stimulus

Government actions could be described as adaptive, but a more accurate description would be a game of whack-a-mole. Different winners/losers, growth/inflation, lockdowns/stimulus, etc., each becoming a new focus, and often caused by the actions taken to counter the previous issue.

Understanding which component of the economy the govt will focus on next is just as important as understanding how the market will respond under a free-functioning economy, which this is anything but.

Summary

Inflation is heating up for various reasons, and there are plenty of experts on both sides with ideas about how far it will rise and how long it will remain. The key metrics we are monitoring are again:

As Christians, we know there is 'nothing new under the sun' (Ecclesiastes 1:9-10), but we have never seen anything quite like this in our lifetimes.

With coordinated monetary and fiscal stimulus (MP3) across developed markets, amidst strong economic growth, with a labor market that continues to tighten. We feel the risk is towards higher inflation over the coming quarters, possibly more than the market is pricing in today.

At Inspire, we believe that the most prudent approach for a long-term investor is to maintain a proper asset allocation with disciplined rebalancing. This can be achieved with an Inspire globally diversified portfolio or individually constructed utilizing our broad array of ETF's. History has proven that discipline and consistency will continue to benefit the patient investor, who is not 'driven with the wind' (James 1:6) depending on the current storm of the day.

For investors who are more short-term in nature, Inspire has several active, tactical risk management strategies that may be more appropriate. For these, we are carefully reviewing the market environment to ensure our best positioning for the coming quarters. Check with us how and we can help determine where you fit on this spectrum and how an Inspire disciplined strategy can best provide investments most appropriate for your needs; all while investing your values and giving glory to God!

Article Contributors

Darrell Jayroe, CFA, CFP, CKA: CHIEF INVESTMENT OFFICER

Darrell Jayroe, CFA, CFP, CKA, serves as Inspire’s Chief Investment Officer responsible for leading the firm’s Investment Committee, as well as serving as Lead Portfolio Manager for Inspire’s ETFs and SMA strategies. Darrell has been with the firm since 2016. Darrell received a B.A. and Masters degree from Southern Nazarene University in Bethany, Oklahoma. He is a CFA (Chartered Financial Analyst) charter holder and is a CFP® (Certified Financial Planner®) licensee. He is a member of the CFA Institute and a member and past President of the CFA Society of Oklahoma. He is also a member of Kingdom Advisors and holds the CKA® (Certified Kingdom Advisor®) designation

Tim Schwarzenberger, CFA: PORTFOLIO MANAGER

Tim Schwarzenberger, CFA is a Portfolio Manager with Inspire Investing and has over 17 years of experience. Tim previously served as the Managing Director at Christian Brothers Investment Services where he was responsible for implementing the firm’s overall investment philosophy through manager selection as well as strategy and product development.

Darrell Jayroe, CFA, CFP, CKA, serves as the Senior Portfolio Manager for Inspire, responsible for leading the firm’s Investment Committee, and serving as Lead Portfolio Manager for Inspire’s ETFs and SMA strategies. Darrell has been with the firm since 2016.

November 10, 2021

October’s higher than expected reading on inflation caught many investors' attention and is sure to be the source of more market volatility going forward.

Of course, a key question is whether inflation will remain elevated or fall back down to pre-pandemic levels. While there are many unknowns and it's still too early to answer the question definitively, here's where Inspire's investment team is focusing its attention.

The Headline Numbers

Beneath the Headline Numbers

Employment

US Money Supply & the Velocity

The Federal Reserve (FED)

The looming question we all have is the FED's response to this latest inflation data.

The FED has two active tools in place that have been in full 'stimulus' mode up to this point. However, we are starting to see indications that they may begin to take their foot off the accelerator over the coming quarters, though still a long way from 'putting on the brakes.'

Global Interest Rates

The level and shape of the yield curve can show the baseline cost of capital for various time horizons. It can also give insight into the market expectations for economic growth and inflation in the future. An upward sloping curve is constructive as it indicates a normal functioning economy.

As the curve begins to flatten or (more ominous) invert, this suggests that economic growth may be in question over this time horizon.

Both measures have different implications depending on the specific sector. For example, financials borrow short-term money through deposits and make longer-dated loans to borrowers, thus benefiting from a higher spread between those rates (steeper curve). Other sectors, such as utilities, are more concerned with the actual level of rates since they tend to have higher debt levels and cannot quickly pass those costs on to customers as rates rise. Similarly, real estate generally carries higher debt loads and thereby has increasing capital costs in a rising rate environment. However, they are more quickly able to pass these rising costs on to customers in response (raise rents). Also, from an inflation perspective, real estate companies are holding 'hard' assets that appreciate along with that inflation and thereby are not directly impacted in the same manner as other businesses.

Fiscal Stimulus

Government actions could be described as adaptive, but a more accurate description would be a game of whack-a-mole. Different winners/losers, growth/inflation, lockdowns/stimulus, etc., each becoming a new focus, and often caused by the actions taken to counter the previous issue.

Understanding which component of the economy the govt will focus on next is just as important as understanding how the market will respond under a free-functioning economy, which this is anything but.

Summary

Inflation is heating up for various reasons, and there are plenty of experts on both sides with ideas about how far it will rise and how long it will remain. The key metrics we are monitoring are again:

As Christians, we know there is 'nothing new under the sun' (Ecclesiastes 1:9-10), but we have never seen anything quite like this in our lifetimes.

With coordinated monetary and fiscal stimulus (MP3) across developed markets, amidst strong economic growth, with a labor market that continues to tighten. We feel the risk is towards higher inflation over the coming quarters, possibly more than the market is pricing in today.

At Inspire, we believe that the most prudent approach for a long-term investor is to maintain a proper asset allocation with disciplined rebalancing. This can be achieved with an Inspire globally diversified portfolio or individually constructed utilizing our broad array of ETF's. History has proven that discipline and consistency will continue to benefit the patient investor, who is not 'driven with the wind' (James 1:6) depending on the current storm of the day.

For investors who are more short-term in nature, Inspire has several active, tactical risk management strategies that may be more appropriate. For these, we are carefully reviewing the market environment to ensure our best positioning for the coming quarters. Check with us how and we can help determine where you fit on this spectrum and how an Inspire disciplined strategy can best provide investments most appropriate for your needs; all while investing your values and giving glory to God!

Article Contributors

Darrell Jayroe, CFA, CFP, CKA: CHIEF INVESTMENT OFFICER

Darrell Jayroe, CFA, CFP, CKA, serves as Inspire’s Chief Investment Officer responsible for leading the firm’s Investment Committee, as well as serving as Lead Portfolio Manager for Inspire’s ETFs and SMA strategies. Darrell has been with the firm since 2016. Darrell received a B.A. and Masters degree from Southern Nazarene University in Bethany, Oklahoma. He is a CFA (Chartered Financial Analyst) charter holder and is a CFP® (Certified Financial Planner®) licensee. He is a member of the CFA Institute and a member and past President of the CFA Society of Oklahoma. He is also a member of Kingdom Advisors and holds the CKA® (Certified Kingdom Advisor®) designation

Tim Schwarzenberger, CFA: PORTFOLIO MANAGER

Tim Schwarzenberger, CFA is a Portfolio Manager with Inspire Investing and has over 17 years of experience. Tim previously served as the Managing Director at Christian Brothers Investment Services where he was responsible for implementing the firm’s overall investment philosophy through manager selection as well as strategy and product development.