De-banking is the practice of financial institutions denying banking services to individuals and organizations based on their religion, politics, race, sex, etc. No American should be denied access to basic financial services because of these protected attributes. Unfortunately, there has been a rising trend of financial institutions politicizing their services, whether through radical environmental commitments,1 colluding with federal law enforcement to profile religious Americans as domestic terrorist threats,2 or outright denying service to certain industries,3 political groups, or religious groups.4

Victims of de-banking in recent years include:

• Indigenous Advance

• Amb. Sam Brownback

• Nigel Farage

• Constitution Party of Idaho

• Core Issues Trust

• Timothy Two Project

• Ruth Institute

• Arkansas Family Council

• Defense of Liberty

• Lance Wallnau

• Dr. Joseph Mercola

• Mike Lindell

• Michael Flynn

• Donald Trump and family

Sources for list above: https://www.viewpointdiversityscore.org/resources/instances-of-viewpoint-based-de-banking; https://www.nbcnews.com/business/business-news/trump-s-top-bankers-deutsche-banks-signature-cut-future-ties-n1253895

This wave of financial censorship has alarmed lawmakers, citizens, and investors across the political spectrum. In early 2025, the U.S. Senate held hearings on de-banking following revelations of what appear to be politically and religiously motivated account closures, including high-profile incidents involving members of the Trump family. Signature Bank closed President Trump’s personal account and publicly called for his resignation after January 6, 2021.5 In March 2023, PNC Bank briefly closed the account of Donald Trump Jr.’s MxM News app, later reversing the decision and attributing it to a “good faith error.”6 Melania Trump revealed in her 2024 memoir that her account had been closed, and her son Barron was denied banking access.

In a speech at Davos in 2025, President Trump criticized the CEOs of Bank of America and JPMorgan Chase, saying that the banks discriminated against conservative clients.7 These events helped spark a rare bipartisan push for reform. Senator Elizabeth Warren expressed interest in working with Senator Tim Scott and the Trump Administration to address regulatory concerns.8 Meanwhile, several states, including Florida, Tennessee, and Idaho, enacted laws in 2024 and 2025 to prohibit viewpoint-based financial discrimination.

Further validating these concerns, documents released by the FDIC confirmed that the federal government, under both the Obama and Biden administrations, had applied informal pressure on banks to limit services to politically disfavored groups. The original "Operation Chokepoint" (2013 to 2015) targeted lawful businesses such as firearms dealers under vague reputational risk standards. More recently, what critics have called “Operation Chokepoint 2.0” has applied similar pressure, particularly against crypto companies, but also against religious and conservative clients, prompting renewed concerns about ideological discrimination in the banking system.9

In response, federal regulators, including the FDIC, OCC, and the Federal Reserve, have taken steps to address these concerns by removing “reputational risk” from their regulatory and supervisory frameworks.10 The recent Executive Order on Guaranteeing Fair Banking for All Americans builds on these efforts, directing federal agencies to eliminate ‘reputational risk’ as a factor and requiring banks to make decisions based on individualized, objective, risk-based analysis.11

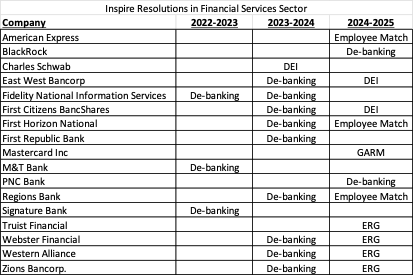

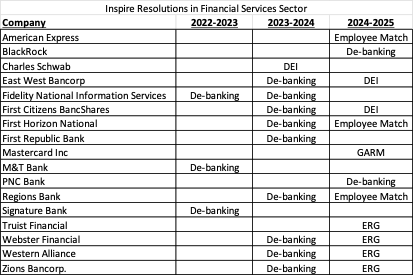

Inspire Investing has been confronting this issue long before it was in the headlines. For several years, we have led shareholder engagement with financial institutions on de-banking, filing dozens of resolutions and Notices of Exempt Solicitation, and working directly with executive teams to protect viewpoint diversity, civil liberties, and religious freedom.

Our multi-year campaign has helped bring meaningful changes at some of the largest financial institutions in the world. Below are some of our key victories from the 2024–2025 season.

Inspire filed a shareholder resolution and engaged directly with Regions to ensure the bank’s policies respected all customers and employees, regardless of political or religious beliefs. As a result of our engagement, the company updated its 2024 Shared Value Report12 with various commitments, including the following:

“…upholding our fiduciary duties by making financially sound decisions without regard to political or social viewpoint.”

“…serving every person, regardless of their political or religious ideologies or affiliations, equally and with dignity and respect.”

We are grateful for the meaningful steps Regions Bank has taken and for its exceptional responsiveness throughout our engagement. In light of this productive dialogue and the company’s commitments, Inspire withdrew its shareholder resolution.

“We appreciate our constructive engagement with Inspire, which has given us an opportunity to reinforce our longstanding commitment to building a culture of fairness, respect, and inclusion for all of our stakeholders, regardless of their beliefs or viewpoints.” - Regions Bank

We filed a resolution at PNC Bank and entered into a series of meetings with leadership. Following this engagement, the company committed to strengthening its non-discrimination language in its Corporate Responsibility Report. As a result, Inspire withdrew its shareholder resolution. PNC stated:

“We serve a diverse group of individuals, families, and businesses across the country. To do so effectively and win in the marketplace, we must recruit and retain talented employees with the relevant experiences, skills, and perspectives to best support them. This is a business imperative, and we work every day to foster an accessible and inclusive workplace where all employees — and customers — can feel welcomed, valued, and respected. To support this imperative, consistent with applicable laws, we do not discriminate against any employee, potential or current client, supplier, or any other stakeholder based on race; color; ethnicity; religion or religious views; national origin; gender; sexual orientation; gender identity; military status; disability; marital or familial status; political opinions, speech or affiliation; or age.” 13

After Inspire filed a shareholder resolution, we met with Western Alliance to discuss viewpoint neutrality and employee protections. The company responded constructively, providing affirmations and agreeing to make updates to its corporate governance materials. Based on the progress made, Inspire withdrew its resolution. Western Alliance has indicated that these updates, including its commitment to employee development and its anti-harassment and non-discrimination policies, will be reflected in its forthcoming Corporate Responsibility Report.

“The Company believes that our people are vital to our success. The Company has a deliberate approach to recruiting and delivering professional development, education and awareness, and community engagement to our employees so that we develop, foster, and sustain a pipeline of talented employees who stay and develop their careers at the Company.”

“The Company also maintains an Anti-Harassment and Discrimination policy that states the Company’s intention to be a workplace free of unlawful harassment and discrimination. The Company strictly prohibits any form of unlawful harassment or discrimination by anyone, including management, managers, coworkers, vendors, suppliers, clients, visitors or any other individuals or third parties on the basis of an individual's race, color, religion, sex, sexual orientation, marital status, gender identity or expression, national origin, age, disability, protected veteran status, genetic information or any other characteristic protected under applicable federal, state, or local law."

We filed a resolution at BlackRock and engaged in several rounds of dialogue with company leaders, including the Head of the Investment Stewardship Team. While the company has not faced public controversy on de-banking, its influence in the market has made it a strategic priority for engagement. We ultimately withdrew our resolution after a set of productive meetings and used the opportunity to advocate for proxy voting neutrality and religious liberty.

In 2024, Inspire helped file a shareholder resolution at US Bank raising concerns about viewpoint discrimination and de-banking. One of the clearest examples of this was the bank’s closure of the account belonging to the Constitution Party of Idaho, a move that drew public backlash and further attention to the issue. The resolution was part of a broader strategy to elevate the issue in the financial services sector.

At the same time, Idaho passed legislation supported by Inspire that prohibits viewpoint-based discrimination in financial services, a move that increased pressure on banks operating in the state. The resolution received national attention, and discussions with US Bank are ongoing.

Learn more about our efforts with U.S. Bank and our partnerships with the Constitution Party of Idaho, American Conservative Values ETF, Alliance Defending Freedom, and a broad coalition of asset managers and investment advisors here.

JPMorgan Chase closed the account of Ambassador Sam Brownback’s National Committee for Religious Freedom in 2022 without explanation, a move that increasingly appeared politically and religiously motivated.

Inspire has engaged with JPMorgan over the past several years and, in 2024, filed a Notice of Exempt Solicitation supporting a shareholder resolution from our friends at the Bahnsen Family Trust and Bowyer Research. The proposal called on the bank to report on how its policies impact employees based on their religious or political views.

In 2025, JPMorgan updated its Fair and Responsible Banking governance framework, formally committing not to deny services based on political or religious beliefs. The new policy includes clear non-discrimination language, documentation protocols for account closures, and internal oversight to prevent future bias. As the largest bank in the United States, this was one of the biggest victories of our coalition this year. 14

Bank of America has also faced scrutiny for closing accounts belonging to religious and faith-based organizations. Ministries such as Indigenous Advance and Timothy Two Project International reported having their accounts abruptly shut down, often with vague explanations that fueled concerns about viewpoint-based discrimination. These incidents drew attention from state attorneys general and intensified calls for reform.

Inspire Investing helped apply pressure to bring about change. In 2024, Inspire mobilized investors representing more than $250 billion in assets to sign on to a Notice of Exempt Solicitation statement of support for Bowyer Research’s shareholder proposal on de-banking at Bank of America. In 2025, as reported by the New York Post, the bank updated its Code of Conduct to clarify that religious or political viewpoints will not be a factor in account closures.

This policy shift provides needed clarity and assurance for customers and stands as another meaningful win for civil liberties in the financial sector and part of the broader momentum Inspire is advancing across major banks.

In 2024, Inspire convened a coalition of investors to file a Notice of Exempt Solicitation in support of a shareholder resolution by the American Family Association. The resolution urged Citigroup to assess how its policies might impact clients with religious or political beliefs, helping elevate de-banking as a key concern among shareholders.

This year, Citigroup made a public statement titled “Reinforcing Our Commitment to Fair Access to Financial Services,” 15 outlining several actions:

• Adopting a Fair Access Statement affirming nondiscriminatory access regardless of political or religious beliefs

• Reviewing account closure procedures to improve transparency and mitigate bias

• Establishing an escalation process for clients to appeal or review account closure decisions

These policy changes reflect positive movement, and Inspire will continue monitoring implementation while advocating for stronger protections for religious and civil liberties in the banking sector.

We are profoundly grateful to God for allowing us to have such success with these companies. It is only by His grace that doors have opened, conversations have been fruitful, and tangible progress has been made in defending freedom and promoting justice in the financial system.

These victories are just the beginning. We thank President Trump for signing this Executive Order, which is a breakthrough moment in the fight against politicized de-banking. It removes the ‘reputational risk’ excuse and requires banks to judge customers by facts, not politics, protecting conservatives, liberals, and everyone in between. We will be watching closely to ensure these changes are implemented in practice and not just on paper. While the EO is a powerful step forward, the ultimate goal is to see these protections codified into law so they are permanent and nonpartisan. Meanwhile, Inspire will continue to file resolutions, mobilize coalitions, and meet directly with company leadership to push for freedom, fairness, and faith-aligned investing.

We are grateful to the leadership at Regions, PNC, Western Alliance, JPMorgan Chase, Citigroup, and others who chose to listen, engage, and act. The changes they made matter. They send a message that America’s financial institutions are not tools for ideological enforcement, but platforms for economic opportunity for everyone.

Join us and help bring freedom in finance. Learn more at www.inspireinvesting.com.

Fox Business News: https://www.foxbusiness.com/media/bank-executives-blow-whistle-how-obama-biden-admins-pressured-them-debank-conservatives

New York Post: https://nypost.com/2025/08/13/business/bank-of-america-axes-rule-that-debanked-religious-conservatives/

ADF Legal: https://adflegal.org/press-release/adf-commends-trump-executive-order-stopping-discriminatory-debanking/

1https://www.unepfi.org/net-zero-banking/

2https://judiciary.house.gov/media/press-releases/new-report-exposes-massive-government-surveillance-americans-financial-data; https://www.warren.senate.gov/newsroom/press-releases/warren-omar-lawmakers_seek-information-from-big-banks-on-account-closure-practices-that-discriminate-against-muslim-americans

3https://www.nbcnews.com/news/us-news/bank-america-stops-financing-makers-military-style-rifles-n865106; https://www.reuters.com/article/usa-immigration/bank-of-america-to-stop-financing-operators-of-private-prisons-detention-centers-idUSL2N23X1JL

4https://www.viewpointdiversityscore.org/resources/instances-of-viewpoint-based-de-banking; https://www.warren.senate.gov/newsroom/press-releases/warren-omar-lawmakers_seek-information-from-big-banks-on-account-closure-practices-that-discriminate-against-muslim-americans

8https://www.banking.senate.gov/imo/media/doc/letter_to_trump_on_debanking.pdf

9https://www.banking.senate.gov/imo/media/doc/gannon_testimony_2-5-25.pdf

11https://www.whitehouse.gov/presidential-actions/2025/08/guaranteeing-fair-banking-for-all-americans/

Tim Schwarzenberger, CFA is a Portfolio Manager with Inspire Investing and has over 20 years of industry experience. He previously served as Managing Director at Christian Brothers Investment Services (CBIS), where he was an integral member of the Investment Team responsible for implementing the firm’s strategy development, portfolio construction, and Catholic investing initiatives.

De-banking is the practice of financial institutions denying banking services to individuals and organizations based on their religion, politics, race, sex, etc. No American should be denied access to basic financial services because of these protected attributes. Unfortunately, there has been a rising trend of financial institutions politicizing their services, whether through radical environmental commitments,1 colluding with federal law enforcement to profile religious Americans as domestic terrorist threats,2 or outright denying service to certain industries,3 political groups, or religious groups.4

Victims of de-banking in recent years include:

• Indigenous Advance

• Amb. Sam Brownback

• Nigel Farage

• Constitution Party of Idaho

• Core Issues Trust

• Timothy Two Project

• Ruth Institute

• Arkansas Family Council

• Defense of Liberty

• Lance Wallnau

• Dr. Joseph Mercola

• Mike Lindell

• Michael Flynn

• Donald Trump and family

Sources for list above: https://www.viewpointdiversityscore.org/resources/instances-of-viewpoint-based-de-banking; https://www.nbcnews.com/business/business-news/trump-s-top-bankers-deutsche-banks-signature-cut-future-ties-n1253895

This wave of financial censorship has alarmed lawmakers, citizens, and investors across the political spectrum. In early 2025, the U.S. Senate held hearings on de-banking following revelations of what appear to be politically and religiously motivated account closures, including high-profile incidents involving members of the Trump family. Signature Bank closed President Trump’s personal account and publicly called for his resignation after January 6, 2021.5 In March 2023, PNC Bank briefly closed the account of Donald Trump Jr.’s MxM News app, later reversing the decision and attributing it to a “good faith error.”6 Melania Trump revealed in her 2024 memoir that her account had been closed, and her son Barron was denied banking access.

In a speech at Davos in 2025, President Trump criticized the CEOs of Bank of America and JPMorgan Chase, saying that the banks discriminated against conservative clients.7 These events helped spark a rare bipartisan push for reform. Senator Elizabeth Warren expressed interest in working with Senator Tim Scott and the Trump Administration to address regulatory concerns.8 Meanwhile, several states, including Florida, Tennessee, and Idaho, enacted laws in 2024 and 2025 to prohibit viewpoint-based financial discrimination.

Further validating these concerns, documents released by the FDIC confirmed that the federal government, under both the Obama and Biden administrations, had applied informal pressure on banks to limit services to politically disfavored groups. The original "Operation Chokepoint" (2013 to 2015) targeted lawful businesses such as firearms dealers under vague reputational risk standards. More recently, what critics have called “Operation Chokepoint 2.0” has applied similar pressure, particularly against crypto companies, but also against religious and conservative clients, prompting renewed concerns about ideological discrimination in the banking system.9

In response, federal regulators, including the FDIC, OCC, and the Federal Reserve, have taken steps to address these concerns by removing “reputational risk” from their regulatory and supervisory frameworks.10 The recent Executive Order on Guaranteeing Fair Banking for All Americans builds on these efforts, directing federal agencies to eliminate ‘reputational risk’ as a factor and requiring banks to make decisions based on individualized, objective, risk-based analysis.11

Inspire Investing has been confronting this issue long before it was in the headlines. For several years, we have led shareholder engagement with financial institutions on de-banking, filing dozens of resolutions and Notices of Exempt Solicitation, and working directly with executive teams to protect viewpoint diversity, civil liberties, and religious freedom.

Our multi-year campaign has helped bring meaningful changes at some of the largest financial institutions in the world. Below are some of our key victories from the 2024–2025 season.

Inspire filed a shareholder resolution and engaged directly with Regions to ensure the bank’s policies respected all customers and employees, regardless of political or religious beliefs. As a result of our engagement, the company updated its 2024 Shared Value Report12 with various commitments, including the following:

“…upholding our fiduciary duties by making financially sound decisions without regard to political or social viewpoint.”

“…serving every person, regardless of their political or religious ideologies or affiliations, equally and with dignity and respect.”

We are grateful for the meaningful steps Regions Bank has taken and for its exceptional responsiveness throughout our engagement. In light of this productive dialogue and the company’s commitments, Inspire withdrew its shareholder resolution.

“We appreciate our constructive engagement with Inspire, which has given us an opportunity to reinforce our longstanding commitment to building a culture of fairness, respect, and inclusion for all of our stakeholders, regardless of their beliefs or viewpoints.” - Regions Bank

We filed a resolution at PNC Bank and entered into a series of meetings with leadership. Following this engagement, the company committed to strengthening its non-discrimination language in its Corporate Responsibility Report. As a result, Inspire withdrew its shareholder resolution. PNC stated:

“We serve a diverse group of individuals, families, and businesses across the country. To do so effectively and win in the marketplace, we must recruit and retain talented employees with the relevant experiences, skills, and perspectives to best support them. This is a business imperative, and we work every day to foster an accessible and inclusive workplace where all employees — and customers — can feel welcomed, valued, and respected. To support this imperative, consistent with applicable laws, we do not discriminate against any employee, potential or current client, supplier, or any other stakeholder based on race; color; ethnicity; religion or religious views; national origin; gender; sexual orientation; gender identity; military status; disability; marital or familial status; political opinions, speech or affiliation; or age.” 13

After Inspire filed a shareholder resolution, we met with Western Alliance to discuss viewpoint neutrality and employee protections. The company responded constructively, providing affirmations and agreeing to make updates to its corporate governance materials. Based on the progress made, Inspire withdrew its resolution. Western Alliance has indicated that these updates, including its commitment to employee development and its anti-harassment and non-discrimination policies, will be reflected in its forthcoming Corporate Responsibility Report.

“The Company believes that our people are vital to our success. The Company has a deliberate approach to recruiting and delivering professional development, education and awareness, and community engagement to our employees so that we develop, foster, and sustain a pipeline of talented employees who stay and develop their careers at the Company.”

“The Company also maintains an Anti-Harassment and Discrimination policy that states the Company’s intention to be a workplace free of unlawful harassment and discrimination. The Company strictly prohibits any form of unlawful harassment or discrimination by anyone, including management, managers, coworkers, vendors, suppliers, clients, visitors or any other individuals or third parties on the basis of an individual's race, color, religion, sex, sexual orientation, marital status, gender identity or expression, national origin, age, disability, protected veteran status, genetic information or any other characteristic protected under applicable federal, state, or local law."

We filed a resolution at BlackRock and engaged in several rounds of dialogue with company leaders, including the Head of the Investment Stewardship Team. While the company has not faced public controversy on de-banking, its influence in the market has made it a strategic priority for engagement. We ultimately withdrew our resolution after a set of productive meetings and used the opportunity to advocate for proxy voting neutrality and religious liberty.

In 2024, Inspire helped file a shareholder resolution at US Bank raising concerns about viewpoint discrimination and de-banking. One of the clearest examples of this was the bank’s closure of the account belonging to the Constitution Party of Idaho, a move that drew public backlash and further attention to the issue. The resolution was part of a broader strategy to elevate the issue in the financial services sector.

At the same time, Idaho passed legislation supported by Inspire that prohibits viewpoint-based discrimination in financial services, a move that increased pressure on banks operating in the state. The resolution received national attention, and discussions with US Bank are ongoing.

Learn more about our efforts with U.S. Bank and our partnerships with the Constitution Party of Idaho, American Conservative Values ETF, Alliance Defending Freedom, and a broad coalition of asset managers and investment advisors here.

JPMorgan Chase closed the account of Ambassador Sam Brownback’s National Committee for Religious Freedom in 2022 without explanation, a move that increasingly appeared politically and religiously motivated.

Inspire has engaged with JPMorgan over the past several years and, in 2024, filed a Notice of Exempt Solicitation supporting a shareholder resolution from our friends at the Bahnsen Family Trust and Bowyer Research. The proposal called on the bank to report on how its policies impact employees based on their religious or political views.

In 2025, JPMorgan updated its Fair and Responsible Banking governance framework, formally committing not to deny services based on political or religious beliefs. The new policy includes clear non-discrimination language, documentation protocols for account closures, and internal oversight to prevent future bias. As the largest bank in the United States, this was one of the biggest victories of our coalition this year. 14

Bank of America has also faced scrutiny for closing accounts belonging to religious and faith-based organizations. Ministries such as Indigenous Advance and Timothy Two Project International reported having their accounts abruptly shut down, often with vague explanations that fueled concerns about viewpoint-based discrimination. These incidents drew attention from state attorneys general and intensified calls for reform.

Inspire Investing helped apply pressure to bring about change. In 2024, Inspire mobilized investors representing more than $250 billion in assets to sign on to a Notice of Exempt Solicitation statement of support for Bowyer Research’s shareholder proposal on de-banking at Bank of America. In 2025, as reported by the New York Post, the bank updated its Code of Conduct to clarify that religious or political viewpoints will not be a factor in account closures.

This policy shift provides needed clarity and assurance for customers and stands as another meaningful win for civil liberties in the financial sector and part of the broader momentum Inspire is advancing across major banks.

In 2024, Inspire convened a coalition of investors to file a Notice of Exempt Solicitation in support of a shareholder resolution by the American Family Association. The resolution urged Citigroup to assess how its policies might impact clients with religious or political beliefs, helping elevate de-banking as a key concern among shareholders.

This year, Citigroup made a public statement titled “Reinforcing Our Commitment to Fair Access to Financial Services,” 15 outlining several actions:

• Adopting a Fair Access Statement affirming nondiscriminatory access regardless of political or religious beliefs

• Reviewing account closure procedures to improve transparency and mitigate bias

• Establishing an escalation process for clients to appeal or review account closure decisions

These policy changes reflect positive movement, and Inspire will continue monitoring implementation while advocating for stronger protections for religious and civil liberties in the banking sector.

We are profoundly grateful to God for allowing us to have such success with these companies. It is only by His grace that doors have opened, conversations have been fruitful, and tangible progress has been made in defending freedom and promoting justice in the financial system.

These victories are just the beginning. We thank President Trump for signing this Executive Order, which is a breakthrough moment in the fight against politicized de-banking. It removes the ‘reputational risk’ excuse and requires banks to judge customers by facts, not politics, protecting conservatives, liberals, and everyone in between. We will be watching closely to ensure these changes are implemented in practice and not just on paper. While the EO is a powerful step forward, the ultimate goal is to see these protections codified into law so they are permanent and nonpartisan. Meanwhile, Inspire will continue to file resolutions, mobilize coalitions, and meet directly with company leadership to push for freedom, fairness, and faith-aligned investing.

We are grateful to the leadership at Regions, PNC, Western Alliance, JPMorgan Chase, Citigroup, and others who chose to listen, engage, and act. The changes they made matter. They send a message that America’s financial institutions are not tools for ideological enforcement, but platforms for economic opportunity for everyone.

Join us and help bring freedom in finance. Learn more at www.inspireinvesting.com.

Fox Business News: https://www.foxbusiness.com/media/bank-executives-blow-whistle-how-obama-biden-admins-pressured-them-debank-conservatives

New York Post: https://nypost.com/2025/08/13/business/bank-of-america-axes-rule-that-debanked-religious-conservatives/

ADF Legal: https://adflegal.org/press-release/adf-commends-trump-executive-order-stopping-discriminatory-debanking/

1https://www.unepfi.org/net-zero-banking/

2https://judiciary.house.gov/media/press-releases/new-report-exposes-massive-government-surveillance-americans-financial-data; https://www.warren.senate.gov/newsroom/press-releases/warren-omar-lawmakers_seek-information-from-big-banks-on-account-closure-practices-that-discriminate-against-muslim-americans

3https://www.nbcnews.com/news/us-news/bank-america-stops-financing-makers-military-style-rifles-n865106; https://www.reuters.com/article/usa-immigration/bank-of-america-to-stop-financing-operators-of-private-prisons-detention-centers-idUSL2N23X1JL

4https://www.viewpointdiversityscore.org/resources/instances-of-viewpoint-based-de-banking; https://www.warren.senate.gov/newsroom/press-releases/warren-omar-lawmakers_seek-information-from-big-banks-on-account-closure-practices-that-discriminate-against-muslim-americans

8https://www.banking.senate.gov/imo/media/doc/letter_to_trump_on_debanking.pdf

9https://www.banking.senate.gov/imo/media/doc/gannon_testimony_2-5-25.pdf

11https://www.whitehouse.gov/presidential-actions/2025/08/guaranteeing-fair-banking-for-all-americans/